Press Releases

As Student Loan Payments Are Set to Restart, Pingree Urges Biden to Waive Loan InterestCongresswoman Pingree and 20 of her House colleagues called on President Biden to extend the moratorium on student loan interest when the forbearance period ends in Jan. 2022

Washington,

December 20, 2021

Tags:

COVID-19 Response

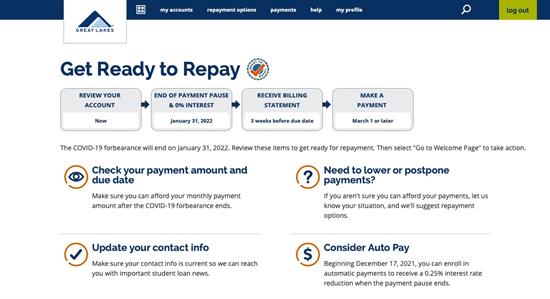

WASHINGTON, DC—Congresswoman Chellie Pingree (D-Maine) and 20 Members of Congress are urging President Joe Biden to continue to waive interest on federal student loans as the nation continues to grapple with the COVID-19 pandemic. The letter comes as the forbearance period for student loans is set to expire in January, despite the ongoing national public health emergency. The lawmakers said, “if no action is taken before February 1, 2022, student loan borrowers will see their interest rates snap back to 4, 5, 6, even 8 percent when student borrowers will have their first payment due.” “Continuing to waive student loan interest will provide financial support during a time when student loan borrowers are still recovering from the economic disruptions and rising costs caused by the pandemic,” they continued. “According to the U.S. Department of Education, waiving student loan interest is saving borrowers an additional $5 billion each month. The accumulation of interest and inflating student loan bills would be an unnecessary burden to borrowers navigating the return to repayment process.” The full letter is copied below and available online here. Pingree is a co-sponsor of the Zero-Percent Student Loan Refinancing Act, which would allow Americans with student loans to refinance to an interest rate of 0% until December 31, 2024, giving them the same opportunity to take advantage of the current low-rate environment that so many borrowers in other sectors of the economy have utilized. Dear President Biden, We applaud your decision earlier this year to extend the student loan forbearance period through January 31, 2022, which has helped millions of Americans during the pandemic. Secretary Cardona has also done outstanding work to untangle the Public Service Loan Forgiveness program and restore student loan borrower protections. Even with this critical assistance, unfortunately many of the 43 million borrowers with federal student loans are still struggling financially, even as the nation’s economy continues to improve. According to the Student Debt Crisis Center's November 2021 survey, 89% of fully employed borrowers do not feel financially secure enough to resume payments when the pause ends on January 31, 2022. The survey also found that for 27% of those borrowers, one-third of their income will go toward their student debt payments next year — during the pandemic, borrowers have used this money to afford basic necessities like food and housing, pay off other debt, and save for future expenses. Your student loan pause executive order has effectively kept the interest rate on loans at 0% through January 31, 2022. However, if no action is taken before February 1, 2022, student loan borrowers will see their interest rates snap back to 4, 5, 6, even 8 percent when student borrowers will have their first payment due. With rates for all other forms of consumer debt currently near zero, this is an unreasonable hardship. Continuing to waive student loan interest will provide financial support during a time when student loan borrowers are still recovering from the economic disruptions and rising costs caused by the pandemic. According to the U.S. Department of Education, waiving student loan interest is saving borrowers an additional $5 billion each month. The accumulation of interest and inflating student loan bills would be an unnecessary burden to borrowers navigating the return to repayment process. For all the reasons above, we strongly encourage you to use your authority under Section 2(a)(1) of the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 to extend a waiver of student loan interest through the end of the national public health emergency. The COVID-19 pandemic continues to place a significant burden student loan on borrowers, and the HEROES Act is the appropriate statutory tool to ensure that federal student loan borrowers are not placed in a worse position financially as a result of the national emergency, in accordance with Section(2)(a)(2)(A) of such Act. As you know, a similar request was made in recent days to you by Senator Raphael Warnock (D-GA) and a number of his colleagues. We urge you to move forward with this request as soon as possible.

### |