Press Releases

Pingree, House Pass Bipartisan Tax Bill to Expand Child Tax Credit, Help Lift Maine Families Out of PovertyThe bipartisan Tax Relief for American Families and Workers Act will make the Child Tax Credit fully accessible to 39,000 more children in Maine with the lowest income and move half a million children across the U.S. out of poverty

Washington,

January 31, 2024

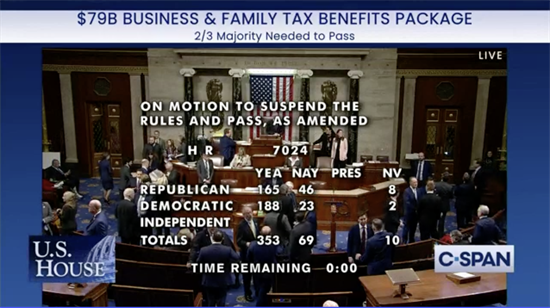

Tonight, Congresswoman Chellie Pingree (D-Maine) and the U.S. House of Representatives passed the bipartisan Tax Relief for American Families and Workers Act, which will expand Child Tax Credit (CTC) accessibility to 39,000 more children in Maine with the lowest income and help lift nearly half a million kids out of poverty. Pingree, a senior member of the House Appropriations Committee, has been a staunch supporter of expanding the CTC and fully restoring and making permanent the enhanced federal program. “The landmark American Rescue Plan enacted by Democrats is one of the most significant pieces of legislation ever passed by Congress—largely because of the tremendous impact the expanded Child Tax Credit had on working-class families in Maine and across the country. The unprecedented progress Congressional Democrats made in 2021 with the expanded Child Tax Credit helped cut child poverty nearly in half within a year,” said Pingree. “While the Tax Relief for American Families and Workers Act is much more modest than the historic provisions in Democrats’ American Rescue Plan, this bill is an important step forward in the fight against child poverty and will help tens of thousands more Maine families meet their basic needs. Now, we must fully restore and make the expanded Child Tax Credit permanent.” The Tax Relief for American Families and Workers Act:

Click here for a detailed fact sheet. Pingree is cosponsor of The American Family Act, which would make the expanded and improved, monthly Child Tax Credit permanent; the bipartisan American Innovation and R&D Competitiveness Act, which would permanently allow for immediate research and development expensing looking back to 2022 when the provision expired; and the bipartisan Affordable Housing Credit Improvement Act, which would support the financing of more affordable housing through expanding and strengthening the Low-Income Housing Tax Credit. ### |